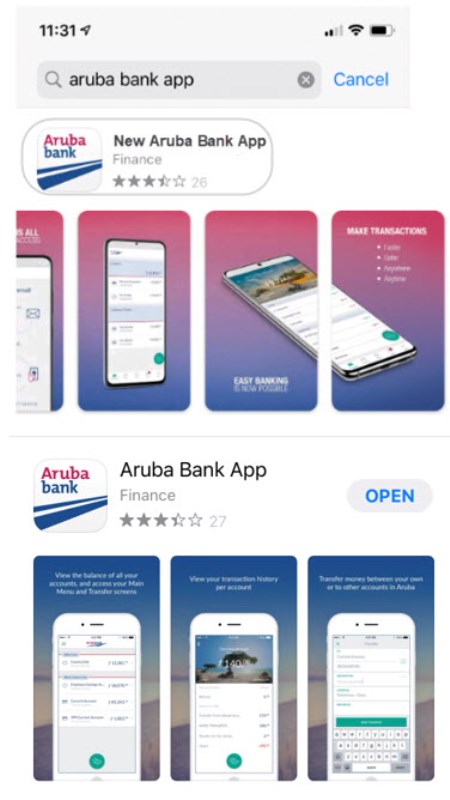

Oranjestad, 20 di januari 2021 – Aruba Bank ta lanza Aruba Bank Online® y Aruba Bank App® nobo y mehora. Nan ta introduci e funcionalidad di un Aruba Bank App® nobo pa nan cliente di negoshi.

Nos a scucha nos clientenan y cu e meta pa satisface nan nos sistema bancario online lo tin un cara nobo y lo ta ‘upgraded’. Desde awe, e Aruba Bank Online® y Aruba Bank App® ta brinda clientenan di negoshi acceso 24/7, ki ora cu ta y unda cu ta.

Aruba Bank a haci inversionnan di varios miyon florin den technologia “state-of-the-art” e innovacion pa mehora y añadi opcion nobo na e servicionan digital aki pa tanto cliente Personal y di Negoshi. Awe nan ta orguyoso di presenta e inversion mas grandi den servicio bancario na Aruba treciendo servicio bancario na e nivel mas halto na Aruba.

E servicionan lo ofrece acceso facil pa uza, online y den tempo real. Un servicio bancario completo, cu ta inclui, habri cuenta, revisa cuenta Personal o di Negoshi atraves di Aruba Bank Online® of Aruba Bank App®, haci transferencia internacional uzando e Aruba Bank App®, cu transferencia mehora riba screen di e web, upload documento personal via mobil, ‘Address Book’ mehora y opcion di comparti ‘Proof of Payment’.

Segun Sr. Arthur Frans, cu a supervisa e avance tecnologico e innovativo, “Pa haci online banking mas conveniente, negoshinan awor por uza e Aruba Bank App® mientras nan ta “on the go”, como tambe un ‘Soft Token’ pa haya acceso online na servicio bancario online, adicional na e “Hard Token” (ABO Pass).”

Sr. Marlon Kock, e Project Manager di e proyecto, tabata feliz pa anuncia cu clientenan existente di Aruba Bank Online® lo ser muda pa e plataforma nobo den e lunanan venidero. E ta recorda tur cliente pa keda pendiente pa email cu mas instruccion unavez nan ricibi accesso pa e Aruba Bank Online® y Aruba Bank App® nobo.

Pa mas informacion por fabor bishita www.arubabank.com/exciting-changes-ahead pa mas informacion.

Tocante e Aruba Bank Online® nobo

Opcionnan a traves di Aruba Bank Online® pa cliente Personal y di Negoshi ta inclui:

- Cliente di Aruba Bank di negoshi y personal por registra pa e soft token, dunando nan e posibilidad pa crea transaccion nobo y aproba transaccion pendiente, ki ora cu ta y na unda cu ta.

- Check saldo di diferente cuentanan, por ehempel: Current, Savings, Loans, Credit Card, y Business Accounts

- Download y print statement cu un logo di banco

- Maneha “address book” personal

- Añadi cuenta nobo automaticamente na e online profile

- Negoshi por switch facilmente entre cuenta y portfolio, “Set Default Portfolio” y maneha cuenta cu ta visibel riba nan home-screen

- Negoshi por manda “Bulk Transfer”, como tambe aproba Bulk Transfer uzando e Aruba Bank App®

- Negoshi por stipula permiso pa sub-usuario

- Negoshi por “Retrieve Audit Report” riba actividad riba cuenta

Cu Aruba Bank Online®clientenan di negoshi lo tin opcion pa uza:

- Aruba Bank “Hard Token” of

- Aruba Bank “Soft Token” uzando e Aruba Bank App®

E Aruba Bank ‘Hard Token’ y ‘Soft Token’ ta duna cliente seguridad adicional. No por uza esaki sin su PIN, haciendo esaki inutil pa otro persona, si e resulta perdi of horta. Cu e Aruba Bank Soft Token, e informacion financiero ta semper protegi. Cu e uso di su PIN, Touch ID of Face-ID, e Aruba Bank App® ta genera un password di un solo biaha cada vez cu e cliente ta log in.

Pa mas informacion por fabor bishita www.arubabank.com/exciting-changes pa mira e variedad di solucion financiero of pa wak e videonan instructivo di e opcionnan di Aruba Bank Online® y Aruba Bank App® pa cliente personal y di negoshi.

Tocante e Aruba Bank App®

E Aruba Bank App ta specialmente diseña pa cliente di Aruba Bank uza un variedad pa maneha nan transaccionnan financiero. Desde e Home Screen e cliente por:

- Check nan saldo di cuenta y transferi historia pa cada cuenta

- Transferencia entre cuenta di e cliente mes

- Transferencia pa otro cuenta local y haci transferencia internacional (nobo)

Uzando e Aruba Bank App®, cliente di Negoshi awor por tambe:

- Login cu Face ID of Finger print (Biometrico)

- Aproba transferencia cu a ser crea riba Aruba Bank Online®

- Aproba Bulk Transfer riba mobile (negoshi)

- Mehora Search di Transaccion cu opcion di comparti Prueba di Pago (Proof of Payment)

- Haya tasa di cambio up-to-date

- Entrega un Notificacion di Biahe (Travel Notice) pa sigura cu e tarhetanan di cliente por ser uza den exterior durante nan biahe.

- Genera codigo si seguridad pa login na Aruba Bank Online® o aproba un transferencia ariba Aruba Bank Online®

- Upload documento a traves di Aruba Bank App®

Pa mas informacion por fabor bishita www.arubabank.com/exciting-changes-ahead pa mas informacion.

PRESS RELEASE – ENGLISH

Aruba Bank Launches New and Exciting Changes for all Personal and Business Customers

Oranjestad, 20 di january, 2021 – Aruba Bank launched their new and improved, Aruba Bank Online® and Aruba Bank App®. for all customers, and especially introducing their Business customers the new Aruba Bank App® for the first time.

We’ve been listening closely to our customers, and in response, our Aruba Bank Online® and Aruba Bank App® now feature a new face and have been upgraded to include even more exciting new features. As of today, Aruba Bank Online® and the Aruba Bank App® provide business customers 24/7 access to the bank, wherever they are and whenever they want.

Aruba Bank has made multi-million guilder investments in “state-of-the-art” technology and innovation to improve and add new features to these digital services for both Personal and Business customers.

Today they are proud to be here to present their next largest investment in Aruban banking services by bringing digital banking to the highest level in Aruba.

The services will offer easy-to-use, online and real time access to account(s) and full banking services, including account opening, view Personal – and Business accounts through Aruba Bank Online® or Aruba Bank App®, make international transfers using the Aruba Bank App®, an improved transfer screens on web, uploading personal documents via mobile, improved address book and Search and Proof of Payment sharing options.

According to Mr. Arthur Frans, who oversaw the technological and innovative advancement, “To make online banking even more convenient, businesses are now able to use the Aruba Bank App® while on-the-go, as a “Soft Token” to access online banking services in addition to the “hard token” (ABO Pass).”

Furthermore, Mr. Marlon Kock, Project Manager of the undertaking, was happy to announce that existing Aruba Bank Online® customers would be migrated to the new platform over the coming months. All customers should remain alert for an email with further instructions once they are enabled to the new Aruba Bank Online® and Aruba Bank App®.

For more information please visit www.arubabank.com/exciting-changes-ahead

About the New Aruba Bank Online®

Features through Aruba Bank Online® for Personal and Business customers include:

- Business and personal banking customers are now able to enroll for the soft token, enabling them to create new and approve pending transactions, while on the go.

- Check their account balance of different accounts, such as, Current, Savings, Loans, Credit Card, and Business Accounts

- Download and print statements with a bank-logo

- Manage Personal Address Book

- New accounts are automatically added to online profile

- Businesses can switch easily between account and portfolios, set default portfolio and manage accounts that are visible on the home-screen

- Businesses can send Bulk Transfers, as well as approve Bulk Transfers using the Aruba Bank App®

- Businesses can set permissions for sub-users

- Businesses can retrieve Audit Reports on activities on accounts

With Aruba Bank Online® business customers will have the following options:

- Aruba Bank “Hard Token”

- Aruba Bank “Soft Token” using the Aruba Bank App®

The Aruba Bank ‘Hard Token’ and ‘Soft Token’ gives customers a double layer of security. It cannot be used without its PIN, making it useless to someone else, should it be lost or stolen. With the Aruba Bank Soft Token, the financial information is always protected. With the use of its PIN, or Touch- or Face-ID, the Aruba Bank App® generates a one-time password each time the client logs in.

For more information please visit www.arubabank.com/exciting-changes

About the Aruba Bank App®

The Aruba Bank App® is especially designed for Aruba Bank clients use a variety of means for handling their financial transactions. From the Home Screen clients can:

- Check their account balance and transfer history for each account

- Transfer between the client’s own accounts

- Transfer to other local accounts and make international transfers (new)

Using the Aruba Bank App®, Business customers can now also:

- Login with Face ID or Finger print (Biometrics)

- Approve transfers that were created on Aruba Bank Online®

- Approve Bulk Transfers on mobile (businesses)

- Improved Search Transactions with sharing options for Proof of Payment

- Find up-to-date exchange rates

- Submit a Travel Notice to ensure clients’ cards can be used overseas during their travels

- Generate secure codes to login to Aruba Bank Online® or approve a transfer request in Aruba Bank Online®

- Upload documents through Aruba Bank App®

For more information please visit www.arubabank.com/exciting-changes-ahead to view the new array of financial solutions or to view the tutorial videos of the Aruba Bank App® features for personal and business customers.